Waycool - E&R Project

Waycool is a farm-to-retailer, agri-tech company

Step-1: Understand

About Waycool

Waycool is a B2B (farm-to-retailer) agri-tech company that operates in 3 categories - Fresh Fruits & Vegetables, Grains & Staples and Dairy. The company has focused operations in South India. Waycool has raised ~$310Mn through equity and debt till date. Operating across 50 regions in the country, WayCool handles more than 1200 tons of food products daily, with a network of more than 150,000 farmers. With a valuation of $722Mn, and strong revenue growth, Waycool has definitely hit PMF.

WayCool's focus is to create a demand-led supply chain where farmers grow based on demand thereby ensuring less wastage and low volatility in prices rather than the traditional supply-led supply chain where farmers grow based on guts and intuition causing periods of shortages and gluts which in turn cause volatility in prices and high wastage.

This project is focused on Waycool's fresh produce business that procures fruits & vegetables from farmers across India and sells it to retailers in Chennai, Bangalore, Coimbatore and Pondicherry. Waycool runs Collection Centers (CCs) in farm clusters where farmers bring their produce which is then graded and packed in crates. Waycool has Distribution Centers in key demand clusters within a particular city for distribution. The state of the art supply-chain built by WayCool ensures that the produce goes untouched from CC to DC and finally to the retailer thus preserving freshness and shelf-life.

Sales Model

Waycool mimics the FMCG sales model and employs a Feet-on-Street (FoS) sales force to visit retailers and nudge them to place orders. Since WayCool operates in a category that is perishable, the natural frequency of ordering is high and the only way to keep costs are under control is to enable the retailer to self-order with a low-to-zero frequency of FoS visits. Considering this, for the purpose of this project, the engagement and retention interventions are focused on self-ordering customers and the effect of FoS visits are not taken into account (this is reasonable considering the high percentage of self-ordering customers at WayCool).

Waycool App

The Waycool application is a customer (retailer) facing app available only on Android. It has 10k+ downloads on PlayStore. Did not find any issues with discoverability on Google Search or PlayStore.

About the Market

Indirect Competition – APMC Wholesale Mandi (The OG Market)

The issues with the market are already covered. Some of the advantages of procuring from the market are:

- Price Discovery – Retailers can find a commodity's price set daily due to supply and demand dynamics.

- Habit & Ikea Effect – For retailers who have been in the business for some time, the daily visit to the market is a habit. In addition, they find the produce chosen by them superior even if it is objectively inferior because of the work they have put in (Ikea effect).

- Easy Access to Informal Credit – Wholesalers extend credit to retailers without the requirement of any formal documentation. Credit is also one of the key drivers of loyalty.

Direct Competition

Direct competitors of WayCool offering similar products and services, in the regions in which it operates are as follows:

- Ninjacart – Recently pivoted to being a marketplace. Ninjacart has a retailer-facing app and a detail teardown is done as part of the study for the project

- BigBasket (BB Mandi) – Detail teardown is done as part of the study for this project

- Several local players operate at a small scale (few pin codes) – Primarily use WhatsApp and act as consolidators; They act as another middle-man between the market and the retailer with delivery as a service.

Problems Faced by Retailers

- Early Morning Hustle – Retailers need to visit the wholesale market early in the morning (~4 AM), scout for good quality produce, and bargain for the right price. Most retailers are 1-2 member businesses and this means significantly less bandwidth for dealing with their customers throughout the day (most shops close by 8 PM)

- Lack of predictability in quality of produce – There are three aspects to quality especially in the context of fresh produce:

- Recovery – How much of the produce purchased is in fact saleable? (A retailer cannot sell produce that is broken, rotten etc.)

- Specification – How much of the produce matches the specifications required by my customers? (A retailer cannot sell oversized or misshaped potatoes)

- Consistency – Can I get similar quality of produce every day? OR How much of the produce in a bag or in different bags conform to my requirements? (Fresh produce is sensitive to weather conditions, storage quality etc. which adds to the complexity in sourcing).

The measure of quality in the wholesale market is subjective – looks, touch and feel. Also, there is variance in recovery and specification on a particular day and overall lack of consistency on a day-to-day basis in the market.

- Freshness – Farmers typically harvest produce during the day and take it to the markets within city limits the next day. The produce changes many hands – Main wholesale market to an ancillary market and then to a retailer. Multiple touch points cause the produce to lose freshness and shelf life.

- Hygiene – The mandi is not maintained well. In addition since it deals with fresh produce, there is accumulation of rotting vegetables in the surroundings. While this is not a major pain point, it is not a pleasant experience for retailers to start their morning in such an environment.

- Access to Credit – Informal credit is available to few retailers but at much higher interest rates than formal credit.

Core Value Proposition

- Primary value proposition - High-quality and consistent quality fruits and vegetables

- Secondary value proposition - Convenience: Door-step delivery everyday

- Tertiary value proposition - Access to formal credit at relatively lower interest rates than informal credit

"Waycool redefines the fresh produce supply-chain for retailers. Our farm-to-retailer supply-chain cuts out the middleman to deliver fresh, high-quality and consistent produce right to your store. Avoid the early morning market visits and unpredictable quality - WayCool ensures you get produce that meet your specifications, with high recovery and consistent freshness, every time. Spend more time with your customers and less on sourcing. We make it easier to keep your shelves stocked with the best, so you can focus on growing your business."

How do users experience it repeatedly?

- Purchasing fruits and vegetables through the WayCool app and selling them to consumers and thereby earning a higher ROI.

Natural Frequency

- Casual Users: 1-2 orders per week

- Core Users: 3-4 orders per week

- Power Users: 6-7 orders per week

Fresh produce is highly perishable & due to lack of cold storage facilities, daily restocking is necessary for a retailer. Considering that WayCool delivers only once a day, the cap on the natural frequency is 7 orders/week.

Sub-Products

Categories -> | Onion, Potato, Garlic, Ginger, Coconut | Other Vegetables & Leafy Produce | Fruits (Domestic & Imported) | Long-Tail SKUs (Golden Berry, Sponge Gourd etc.) |

|---|---|---|---|---|

Category Name (Will be used as a proxy for the category in this document) | OP | Country Veggies | Fruits | LT |

About | Relatively High Shelf-Life | Low Shelf-Life | Relatively Medium Shelf-Life | Low-Medium Shelf-Life |

Natural Frequency - Casual | 0-1 orders/week | 0-2 orders/week | 0-1 orders/week | 0-1 orders/week |

Natural Frequency - Core | 1-2 orders/week | 3-4 orders/week | 1-2 orders/week | 0-1 orders/week |

Natural Frequency - Power | 2-4 orders/week | 6-7 orders/week | 3-7 orders/week | 1-2 orders/week |

Engagement Framework for the Product

Framework Chosen: New product/Feature Engagement (Breadth of offering)

Rationale:

- Waycool has a wide-variety of produce to offer (~60 SKUs)

- The more SKUs the retailer orders and then sells to end consumers, the more happy consumers are with the quality, the more they return to the retailer and hence the more ROI he makes -> he hence experiences the value proposition more

- This is also arrived at by method of elimination:

- Depth (AOV = f(Quantity x No. of SKUs)) is NOT the right engagement framework since every retailer has a cap on the quantity he can buy on a particular day. This quantity is a function of the neighborhood population and competition for the retailer and is usually constant for a long time. It is also next to impossible to ascertain if there is any opportunity to sell more quantity of a particular SKU. Secondly, the behavior of the retailer opposes choosing depth - a retailer will most likely not buy the same SKU from different vendors,

- Frequency is also NOT the right engagement framework since this is a low gross-margin business and a high frequency at a low AOV is disastrous for the business. Last-mile delivery costs skyrocket when utilization of the vehicles are low.

Step 2: Define

Actions of Active Users:

The following actions make someone an active user:

- A minimum of 1 transaction in the last 7 days

- A minimum of 4 SKUs purchased in the last 30 days

Rationale:

- Retailers do not store fresh produce since it is perishable and hence order them everyday. There are few SKUs like Onion, Potato, Garlic etc. that have a shelf life of about a week. So, the time window for calling a user "Active" is set to 7 days.

- Ordering 1-2 SKUs only would mean that the purchases are purely opportunistic and the customer is taking a call basis the price. Since our value-prop is quality, we would like the user to experience it through different SKUs.

Natural Frequency:

Casual Users: 1-2 orders/week

- Casual users are generally those that have not experienced the full value-proposition of WayCool.

- Ex - Users who have recently onboarded but are skeptical and show low commitment. They generally stick to staple SKUs like onion, potato etc. that are low risk.

Core Users: 3-4 orders/week

- Core users have experienced the value proposition of WayCool and have typically divided SKUs between different vendors with WayCool being one of them.

- Ex - Users who are happy with WayCool's quality of some vegetables order them everyday with the rest purchased from the market OR the same users order with different vendors on different days.

Power Users: 6-7 orders/week

- Power users DEPEND on WayCool for ~80% of their supplies and they have fully experienced the value proposition of WayCool. They buy a large part of the range and only go to other vendors as a backup.

- Ex - Users who started with staple SKUs like Onion & Potato, quickly started ordering other SKUs and seeing results due to which they changed their vendor to WayCool. They also try the long-tail SKUs and found good results.

Step 3: Segment

A. Persona Based Segmentation (ICP)

Rationale for Choosing Persona Based Segmentation:

ICPs | Young "Heir"/Young Entrepreneur (ICP1) | Affluent Neighborhood & Modern Trader (ICP2) |

|---|---|---|

Age (of Owner) | Less than 40 years | Less than 55 years |

Gender (of Owner) | Male | Male |

City | Bangalore, Chennai, Coimbatore, Pondicherry | Bangalore, Chennai, Coimbatore, Pondicherry |

Education Level | Basic degree or Less | Basic degree or Less |

Marital Status | Married/Un-married | Married |

Risk Appetite of Owner (indicator of time to value of the customer) | Low | Medium-High |

Type of Company Registration | Sole Proprietorship | Sole Proprietorship |

Type of Operations | Direct Family Operated | Direct / Extended Family Operated |

Shop Size* | Single Door/Double Door | Double Door (minimum) |

Socio-Economic Status of Neighborhood of Shop | Lower Middle Class/Middle Class/Upper Middle Class | Middle Class/Upper Middle Class/Rich |

Distance of Shop from Mandi | >10km | >10km |

Annual Household Income | Rs. 6L - Rs. 10L | Rs.10L - Rs.30L |

Type of Vehicle Owned | 2–Wheeler | 2–Wheeler and/or 3–Wheeler (for purchases) |

Mobile Phone – Android/iPhone | Android | Android/iPhone |

Business Vintage (Age of Shop) | Less than 8 years | Less than 8 years |

Type of Store | Small Kirana Store | Modern Trade Store |

No. of Employees/Family members working for the store | 1-2 | 2-5 |

Typical Day – Daily Schedule & Time Spent | 3am – Wakeup 4am - 6am - Commute in Auto-rickshaw & visit Mandi for purchases 6am–11am – Take care of store activities and sales 11am - Handover shop to a family member/employee and return home 12pm-4pm - Sleep 4pm–11pm – Household Chores & Entertainment (TV mainly), Spend time with family and on Social Media 11pm - Sleep | 6am – Wakeup 6:30am - Arrive at shop in Car/Bike – Open shop and inward all material received (Employee or family member goes for purchases to Mandi) 7am - 11am - Be the cashier since it is peak time for sales 11am - 4pm - Relatively free time, spend time watching Movies/Cricket, Social Media 4pm–8pm – Relatively busy time in the shop 8pm – Shut shop and return home 9pm–11pm – Family time, Watch TV 11pm - Sleep |

Time Spent on Commute | 2-4 hours | 0.5-1.5 hours |

Overall Assessment of Time Spent | Very early waking time, lack of quality sleep and physical work of visiting mandi and moving produce to the store makes it clear that BASIC COMFORTS are missing. Also a lot of time is spent in commute (mostly self-driven) which adds to the stress. | While the day starts early, lot of free time available in the afternoon. Indication of more bandwidth for giving attention to little aspects of the shop like arrangement of F&V etc. |

Lean Day of the Week | Monday (Weekends are peak sales days) | Monday & Thursday (Weekends and Wednesday are peak sales days) |

Mandi Visits per Week | 4-5 times | 1-2 times |

Apps Used | YouTube, MX Player, Cricbuzz, PocketFM, Instagram, WhatsApp, Facebook, Khatabook | YouTube, MX Player, Cricbuzz, PocketFM, Instagram (based on age), WhatsApp, Facebook, Khatabook |

Free Time - Slots During the Day | 4pm onwards | 11am - 4pm |

Problem Statement/Frustration Faced (With regard to F&V purchases) |

|

|

Spending Patterns |

|

|

Product Usage – Time of Day when product is used | 4pm-6pm | 1pm-6pm |

Most valued features and reasons |

|

|

Natural Frequency | 3-7 orders/week | 1-3 orders/week |

Avg. Money Spent on the Product/Order | Rs.30,000-Rs.50,000 (High Wallet Share) | Rs.50,000-Rs.75,000 (Medium Wallet Share) |

Avg. Sales per Day of the Shop (Total Opportunity) | Rs.50,000-Rs.75,000 | Rs.1,20,000 – Rs. 2,00,000 |

Buying Decision (Quality vs Service vs Price) | Service>Price>Quality | Quality>Price>Service |

B. Power/Core/Casual Based Segmentation

Rationale for Choosing Power/Core/Casual Based Segmentation

Power | Core | Casual | |

|---|---|---|---|

Product Usage Behavior |

|

|

|

Characteristics |

|

|

|

Corresponding ICPs | ICP1 | ICP1/ICP2 | ICP2 |

Advanced Segmentation |

|

|

|

Typical Profile | A young kirana store owner in a middle-class neighborhood who is well versed with the internet and wants to progress in business & life | A middle aged kirana store owner OR a modern trade store owner who knows about the internet and is slightly skeptical and resistant to change. | A new user on WayCool who is testing the product out. |

Pain Points |

|

|

|

Step 4: Engagement

Engagement Campaigns

Casual to Core - Problem Solving:

Campaign 1:

Type of User | Casual customers with order history of very few SKUs but medium AOV (signal of opportunity) |

|---|---|

Goal | Casual to Core conversion by increasing AOV (primary goal) and No. of SKUs ordered (secondary goal) |

Channel | Whatsapp and Notifications |

Offer | 5% off on cart value. Min cart value of Rs.9999 & Min. no. of SKUs is 5. Maximum discount value is Rs.2500. The offer is to be directly applied without the use of any coupons. |

Offer Justification |

|

Frequency & Timing | Offer to be run once a month for a week. The week of the month to be decided randomly so that there is no habit formed on discounts.

|

Success Metrics |

|

Other Metrics to Track | 1. Whatsapp message read rate |

Creatives:

Creative A: Added "exclusive" and "special" to entice the user.

Creative B: The image to be that of a successful retailer in front of his store.

Creative C (Notification):

Campaign 2:

Type of User | Casual customers at low distance from the market (10km-15km) |

|---|---|

Goal | Casual to Core conversion by increasing the no. of SKUs ordered. |

Channel | Whatsapp, Notifications, In-App Banner at Checkout |

Offer | Free delivery if you order 10+ SKUs |

Offer Justification | As stated in the ICPs, distance from Mandi is a big indicator of a high potential user since delivery charges seem too high for this segment. 4. This campaign will definitely help to better cart abandonment rates due to delivery charges. |

Frequency & Timing | Offer to be run once a month for 2 weeks. |

Success Metrics |

|

Other Metrics to Track | 1. Whatsapp message open rate 8.Delivery CSAT |

Creatives

Creative A: Added "limited period offer" to add scarcity

Creative B: Added "limited period offer" to add scarcity. Image of a truck racing to be used.

Creative C: Clear and simple CTA - "Free Delivery Unlocked"

Creative D: Nudge the user at Checkout to add more SKUs.

Campaign 3:

Type of User | Casual customers with order history of only OP category |

|---|---|

Goal | Casual to Core conversion by increasing the no. of SKUs ordered. |

Channel | WhatsApp, Notifications, Catalogue Page |

Offer | Value Pack - Bundle of 5 country veggies of 10kg each at 10% discount |

Offer Justification | It is observed that many casual users only order from the OP category mostly since they are not confident of WayCool's promise. 5 SKUs that are staples to any store are chosen so that it is universally applicable. 5.Making a value pack of small quantity means that the retailer will have a comparison set when material is delivered. He can easily compare quality of his market purchased material and WayCool material. It will help remove any doubts and help change perception. |

Frequency & Timing | Offer to be run once a month for a week. The week of the month to be decided randomly so that there is no habit formed on discounts. Catalogue Page: Add value pack in the catalogue page. - Creative D |

Success Metrics | 1. No. of value pack orders 4.No. of SKUs per order 5.No. of categories per order |

Other Metrics to Track | 1. Whatsapp message open rate 8.Value pack product page views, conversion, bounce rate |

Creatives

Creative A: SKU list shared here to prevent any disappointment later.

Creative B: Image of all the listed SKUs in a basket.

Creative C: Clear and easy to understand CTA

Creative D: Added the value pack in the catalogue page.

Core to Power - Problem Solving:

Campaign 4:

Type of User | Core customers (vintage > 1 month) who have minor/no changes in No. of SKUs orderd in the last 30 days |

|---|---|

Goal | Core to power conversion by offering credit to increase no. of SKUs ordered |

Channel | Whatsapp, Notifications, In-App Banner, Catalogue Page |

Offer | Interest free credit facility for 1 order per week. Max value Rs.20,000 and credit period is 7 days. Applicable only if cart value is > Rs.30,000 |

Offer Justification | Insight - A retailer divides the share of wallet to each vendor based on payment terms (price is a qualifier). If a retailer has less cash on a particular day, he changes the share of wallet to prefer vendors who give credit. This was confirmed in user conversations. 1. Access to formal credit is a major pain-point for retailers and hence go to players in the Mandi who provide informal credit at exorbitant rates. Offering credit can definitely unlock more opportunity from core users. |

Frequency & Timing | Offer to be run twice a month for a week (alternate weeks to ensure collection from the first offer week). |

Success Metrics | 1. No. of customers subscribing to the credit offering 6.AOV |

Other Metrics to Track | 1. Whatsapp message open rate |

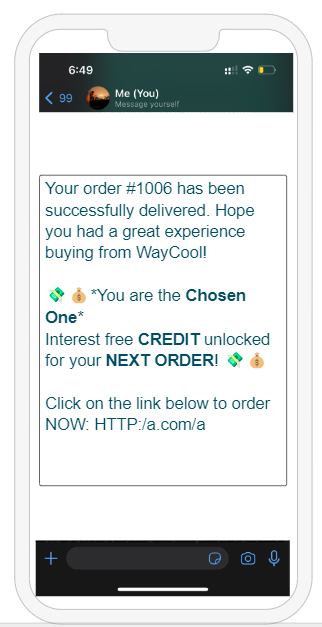

Creatives

Creative A: Not giving away all the information to get the user excited.

Creative B: Image of a retailer counting cash at the cash counter

Creative C:

Creative D:

Campaign 5:

Type of User | Core customers |

|---|---|

Goal | Core to power conversion by increase in breadth - No. of SKUs ordered |

Channel | Whatsapp, In-App Banner, Checkout Page |

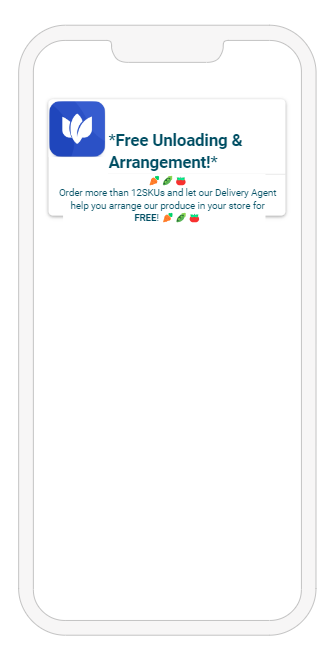

Offer | Free service of unloading and arranging the produce in the store by the delivery agent if more than 12 SKUs are ordered. |

Offer Justification | 1. As seen in the brainstorming, this is an issue. Labor is short but WayCool has a strict policy of no returns once accepted and WayCool also takes back crates post unloading at the point of delivery. The retailer may not have labor or time to unload the crates. |

Frequency & Timing | Offer to be run everyday for a month. If the campaign is successful, it can be turned into a product hook. |

Success Metrics | 1. No. of customers qualifying for the offer 5.Delivery CSAT |

Other Metrics to Track | 1. Whatsapp message open rate |

Creatives

Creative A:

Creative B:

Creative C:

Creative D:

Creative E:

Step 5: Retention

Understand

Bird's Eye View:

- What is your current retention rate in terms of users?

- Basis the data, the retention rate is ~50%.

- The numbers seem to match industry benchmarks comfortably - E-commerce retention rates are ~38% and the number for a B2B player would be higher than that.

- At what period does the retention curve flatten?

It can be seen from the above retention chart that the retention curve flattens over 9 months.

Microscopic View:

- Which ICPs drive the best retention?

- Power and core users drive the best retention and the reasoning is as per the table below:

Core | Power |

|---|---|

All of the above indicate medium-high commitment |

All of the above indicate High commitment |

Core users are loyal to a category or their selection of products | Power users are loyal to WayCool |

The category that Core users buy are associated with high retention (country vegetables) | Power users transact across all categories which is associated with higher retention |

Over time, it is habit forming at least for the category (since users tend to not try to solve a problem they don't yet have for other categories) | Habit already formed since they usually stop visiting the market as >80% of their requirements come from WayCool |

- What channels drive the best retention?

- Based on user conversations, it was clear that customers in this Target Group require a touch-and-feel approach and a pure digital play is not ideal

- It seemed from user conversations that the FoS sales team was actually a KAM (Key Account Management) team rather than a sales team

- Hence, the channel that drives the best retention is the on-ground sales team visits to the store.

- The second best channel seems to be WhatsApp as many customers remembered the messages they received.

- What sub-features or sub-products drive the best retention?

- Based on user conversations and data, it is clear that country vegetables (first) and fruits (second) drive the best retention.

- The reasons for these are that WayCool's hero products are country vegetables and fruits where they have a strong relationship with farmers and a deep sourcing network.

Define:

- What are the top reasons for user churn?

Voluntary | Involuntary |

|---|---|

Product availability issues | Shop closed permanently |

Late delivery issues | Started to open the shop very late (post WayCool delivery time slots) |

High prices | Moved to a grocery category fully OR stopped Fresh category |

Product quality issues | |

Minimum Order Quantity set by WayCool is higher than capacity of customer |

- Negative Actions

- Low NPS/CSAT scores

- Reason - The user is dissatisfied with the product and/or service offered by WayCool and is communicating the same through the scores

- Impact - Bad WoM in terms of PlayStore reviews, drop in revenue

- Reduction in avg. no. of SKUs purchased

- Reason - The user maybe dissatisfied with the products and may have already found an alternative.

- Impact - Lower revenue

- Reduction in AOV

- Reason - The user maybe dissatisfied with the products and maybe assessing alternate vendors and has hence reduced AOV

- Impact - Lower revenue

- Reduction in Frequency of purchase

- Reason - The user may have gone back to visiting the market for purchases regularly and now treats WayCool as a backup option

- Impact - Lower revenue

- Unsubscribing from WhatsApp/SMS

- The user is not interested in any communication and it may be treated as spam

- Impact - High cost of engagement as it will require an FoS salesperson to visit

- Disabling Push Notifications

- The user is not interested in any communication and treats it as spam

- Impact - High cost of engagement as it will require an FoS salesperson to visit

- Credit - Pre-paying full amount outstanding

- The user wants to move on from WayCool and hence does not want any obligations

- Impact - Lower margins due to loss in interest

Resurrection Campaigns

Campaign 1: Product Availability Issues

Type of User | Core users who rated CSAT for ordering < 4 and also selected the reason as availability. The users selected for the campaign must have experienced it at least twice in the last 7 days. These users can be considered "at risk" |

|---|---|

Goal | Retain "at-risk" core users who are dissatisfied due to product availability issues. |

Offer | 5% discount on next order on previously unavailable products up to Rs.2500 |

Offer Justification |

|

Frequency & Timing | Offer to be run everyday for a week starting the day the items are back in stock. The offer is to be applied directly without any coupon codes etc.

Notifications:

Nudge on Checkout page to add SKUs:

|

Success Metric | 1. Offer redemption rate |

Other Metrics | 1. Whatsapp message read rate |

Creatives:

Creative A:

Creative B:

Creative C:

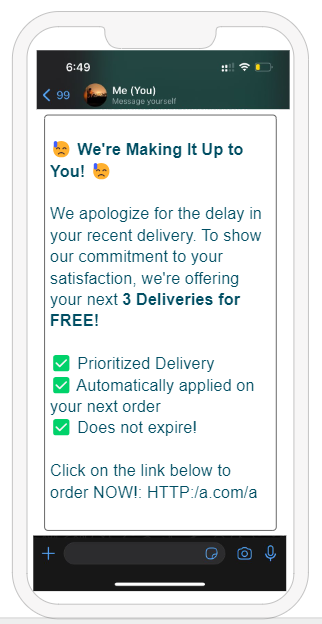

Campaign 2: Late Delivery Issues

Type of User | Core users who rated CSAT for delivery < 4 and also selected the reason as late delivery (reason to be verified based on delivery time). The users selected for the campaign must have experienced it at least twice in the last 7 days. These users can be considered "at risk" |

|---|---|

Goal | Retain "at-risk" core users who are dissatisfied due to late delivery issues. |

Offer | Free delivery for the next 3 orders. No expiry and automatically added. |

Offer Justification |

|

Frequency & Timing | Offer to be run everyday for a week starting the day the customer provides a low CSAT rating and will continue till the customer places 3 orders.

Notifications:

Banner on Landing Page:

|

Success Metrics | 1. Offer redemption rate |

Other Metrics | 1. Whatsapp message read rate 7.CSAT of delivery for next 3 orders |

Creatives:

Creative A:

Creative B:

Creative C:

Campaign 3: High Prices

Type of User | Casual users who have churned due to concerns on pricing. These users can be considered as price sensitive for some categories and low price awareness for others. |

|---|---|

Goal | Resurrect casual users who churned due to concerns on pricing. |

Offer | Super Saver Bundle - 50kg Onion + 50kg Potato at 5% discount. Offer unlocked on adding at least 3 SKUs |

Offer Justification |

|

Frequency & Timing | Offer to be run everyday for a week every month. Since the customer may have uninstalled the app, there is too much friction to download app+ install app+ place order. As our Target Group appreciates touch-and-feel, a physical visit by a sales person to communicate the offer and explain the benefits is required. Timing - Salesperson to visit during off-peak hours of the day - 1PM to 6PM Frequency - Salesperson to visit every alternate day for a week (even if offer redeemed) Salesperson to give the customer a brochure showing benefits of the offer - Creative A |

Success Metrics |

|

Other Metrics |

|

Creatives

Creative A:

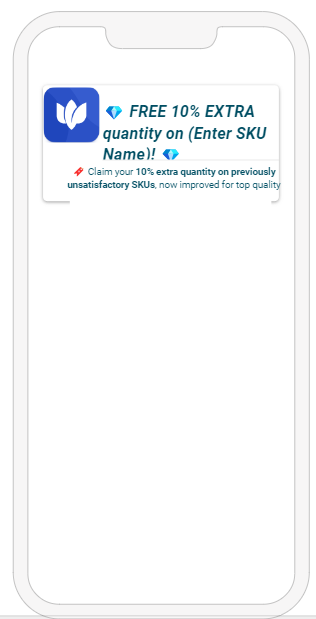

Campaign 4: Product Quality Issues

Type of User | Core users who rated CSAT for quality < 4 and also selected the reason as 'Bad Quality' (reason to be verified by checking spike in sales returns). The users selected for the campaign must have experienced it at least twice in the last 7 days. These users can be considered "at risk" |

|---|---|

Goal | Retain "at-risk" core users who are dissatisfied due to quality issues |

Offer | 10% extra quantity on returned items free in the next order up to a maximum of 50kg |

Offer Justification |

|

Frequency & Timing | Offer to be run everyday for a week starting the day the customer provides a low CSAT rating and will continue till the customer places the next order.

Notifications:

Banner on Landing Page:

|

Success Metrics | 1. Offer redemption rate |

Other Metrics | 1. Whatsapp message read rate 7.CSAT of quality for next 3 orders |

Creatives

Creative A:

Creative B:

Campaign 5: MOQ Issues

Type of User | Casual user who is a very small Kirana store or a pushcart who has churned. (WayCool collects this information at the time of onboarding.) |

|---|---|

Goal | Resurrect a casual user who churned due to high MOQ issues since MOQ is greater than users capacity |

Offer | Make your Own Crate of 20kg - Add up to 5 SKUs to total 20kgs |

Offer Justification |

|

Frequency & Timing | Since the customer may have uninstalled the app, there is too much friction to download app+ install app+ place order. As our Target Group appreciates touch-and-feel, a physical visit by a sales person to communicate the offer and explain the benefits is required. Timing - Salesperson to visit during off-peak hours of the day - 1PM to 6PM Frequency - Salesperson to visit every alternate day in W1 (even if offer redeemed), twice in W2 and once in W3 Salesperson to give the customer a brochure showing benefits of the offer - Creative A |

Success Metrics |

|

Other Metrics |

|

Creatives

Creative A:

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.